Pre-Retiree/Retiree

Retirement Planning for the Next Phase of Life

Planning for the next steps can be complex as you consider all the decisions ahead. Deciding when to retire, take Social Security, and understand the tax impact of your decisions. There are a lot of decisions ahead.

Answer The Important Questions...

Savings

- Am I saving enough to achieve my retirement goal?

Retirement Income

- How will you maintain your lifestyle in retirement?

Taxes

- How can You reduce the impact taxes will have on your retirement?

Investment Management

- How will invest to provide income and stability for you while retired?

Incapacity Planning

- What happens if/when you can no longer care for yourself?

Estate Planning

- Have you prepared for the smooth transition

Take Steps to Turn Your Hard Work and Vision into Actions

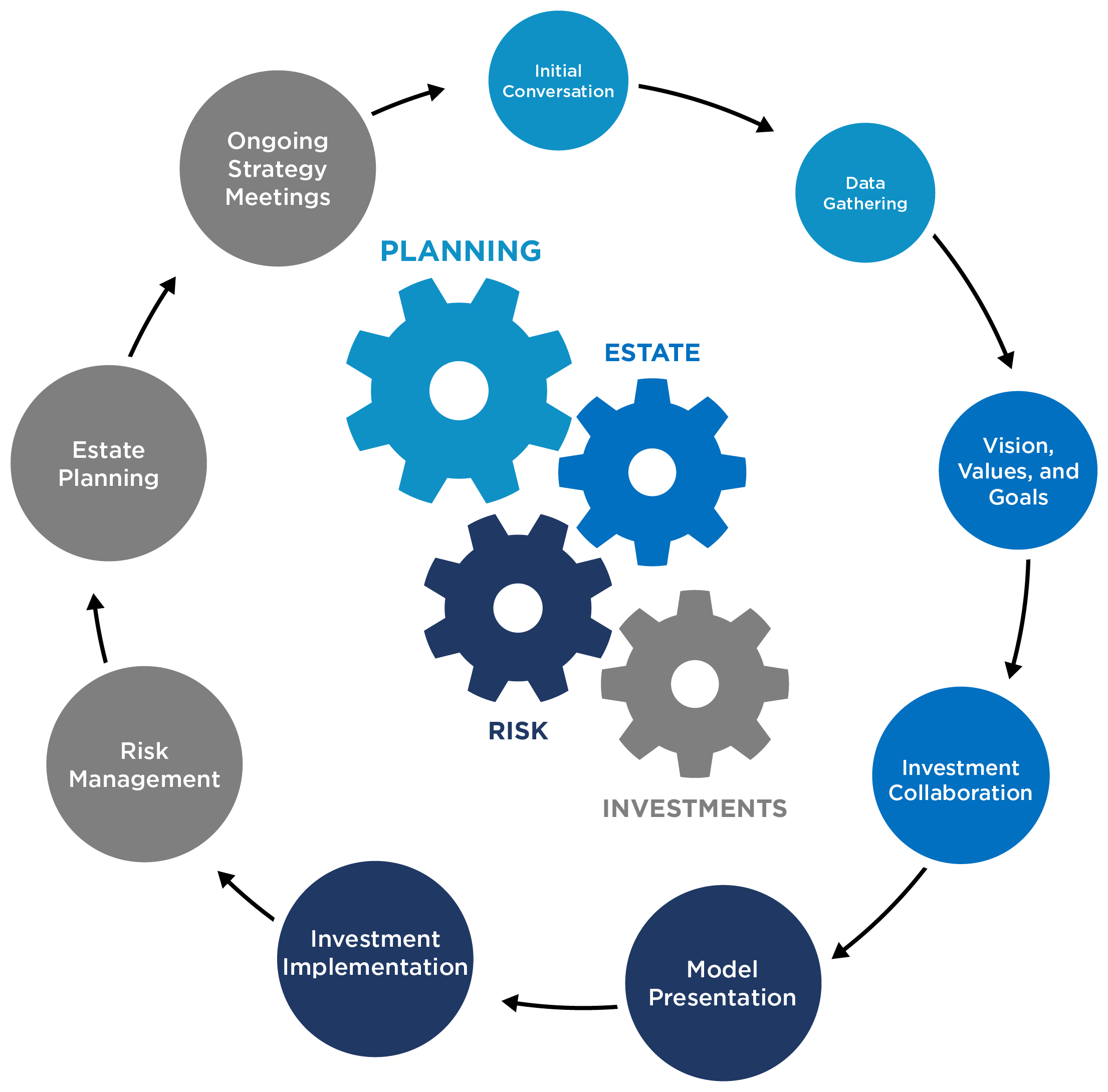

Our multi-step Wealth Planning Process is designed to help us get to know you and to collaborate to build the best strategy for your situation.

We Guide You

Develop a Plan Based on Your Unique Situation

You may want personalized guidance or ongoing management.

There is an option for you.

Options tailored your needs

Compare Our Options

| Retirement Plan | Ongoing Retirement Management | |

|---|---|---|

| Personal Financial Statements | ||

| Retirement Cash Flow Analysis | ||

| Income Tax Return Review | ||

| Investment Allocation Recommendation | ||

| Insurance Review | ||

| Estate Document Review | ||

| Goal Projections | ||

| Tax Planning | ||

| Cashflow Management | ||

| Investment Management | ||

| Business Owner Planning | ||

| Business Owner Retirement Plan |

Friends, family, and the internet have answers. The challenge is getting answers that work for you and your specific situation.

Options tailored for you and your needs

YOU MAY NEED TO KNOW

Frequently Asked Questions

Are you a fiduciary?

Are you a fiduciary?

Yes. The fiduciary standard is the highest standard for financial professionals. The advice we provide is fiduciary.

Do I have to move my assets to work with you?

Do I have to move my assets to work with you?

No. With our Retirement Plan option, we collaborate with you to build a unique plan and you can keep your assets where you'd like.

Get Started Building a Plan for a Better Future